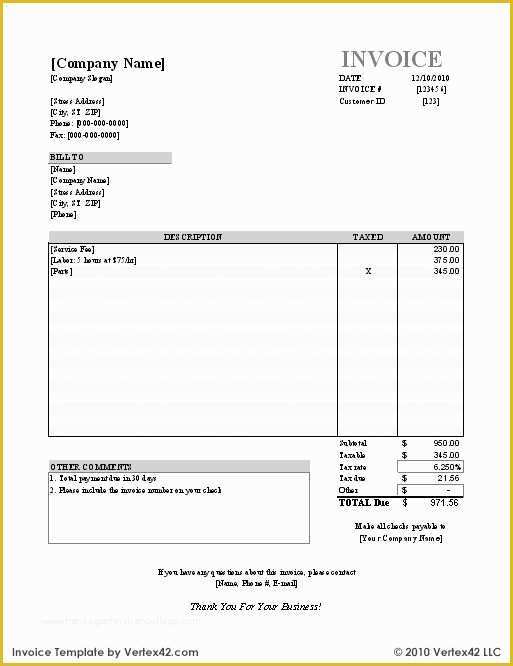

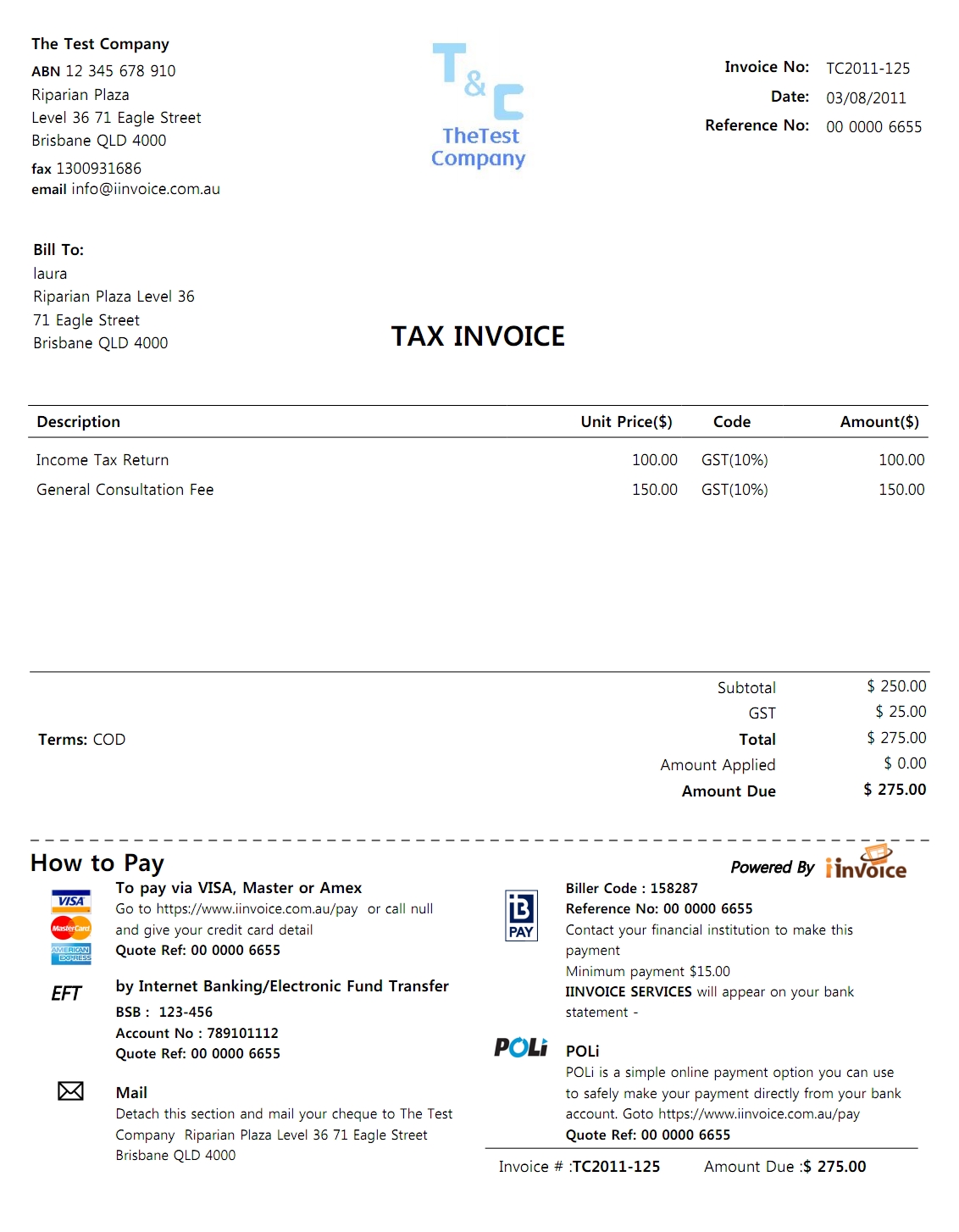

You could have to wait 5-7 days to receive funds as some bank take this long to complete a transfer. However, we wish being paid to be of top priority so a very gentle reminder here is often all it takes to have payment sent over. People are busy, and often there is no ill intentions when an invoice is unpaid and it is simply a case of it either being forgotten or pushed down your clients list of priorities. If there is no response to your email by the next day you can follow up with a quick telephone call to the client or their accounts department. Sometimes it can be a simple oversight or an administration error and we want to give our client the benefit of the doubt here. If the due date has come and gone and the invoice remains unpaid you can send a casual reminder via email outlining the details. You should have an invoice template saved so it’s easy to use each time.ĭue date + 1 day ( 1st unpaid invoice letter ) Having a small note at the bottom of the invoice saying something like ‘late payments will incur statutory interest & charges’ on all invoices can help later down the line. A warning that you charge interest for late payments.There are additional items you can record on an invoice that can help you recover your money more quickly:

#Unpaid invoices small business full

If the sum of money you are expecting is large, it may be a good idea to contact the client one week before the payment is due just to make sure everything is alright and to remind them that you are expecting payment. You then only need to go through the motions until payment is received, the client agrees to payment terms or insolvency proceedings are initiated. If you follow the steps below and keep copies of all your documents you will have performed all the necessary tasks in the eyes of the law.

Take a look at the Alternative Dispute Resolution (ADR). If you do take your case to court you will be expected to show some supporting evidence (emails, letters etc) showing that you tried to find a solution but had no option but to take legal action. There are also alternatives to going to court that you should look at before pursuing court action. It should be noted that there are other methods that a business may use to increase working capital in the short term such as Invoice Factoring and Invoice Discounting. How long you leave it between letters is up to your own judgment. What to do if my client has not paid an invoice?īelow I will list an example of the steps you can take to recover your unpaid invoices.

0 kommentar(er)

0 kommentar(er)